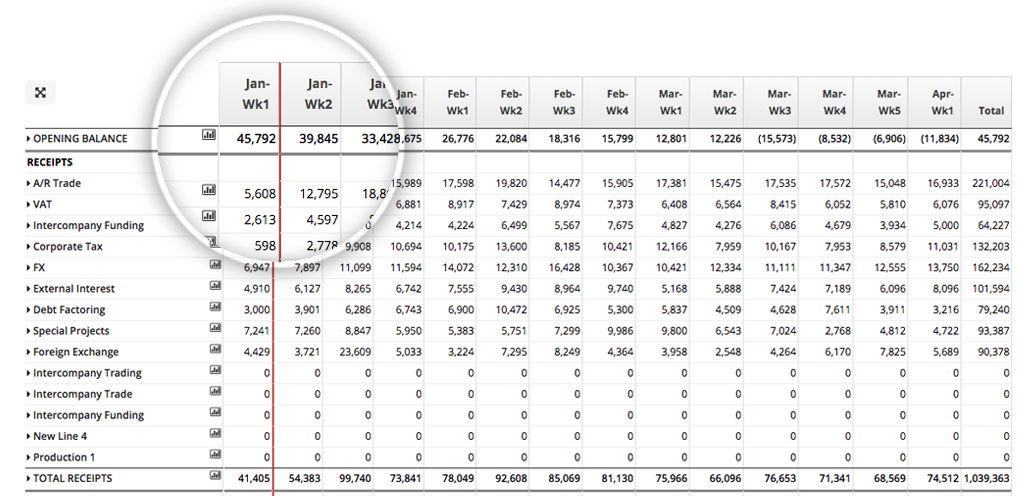

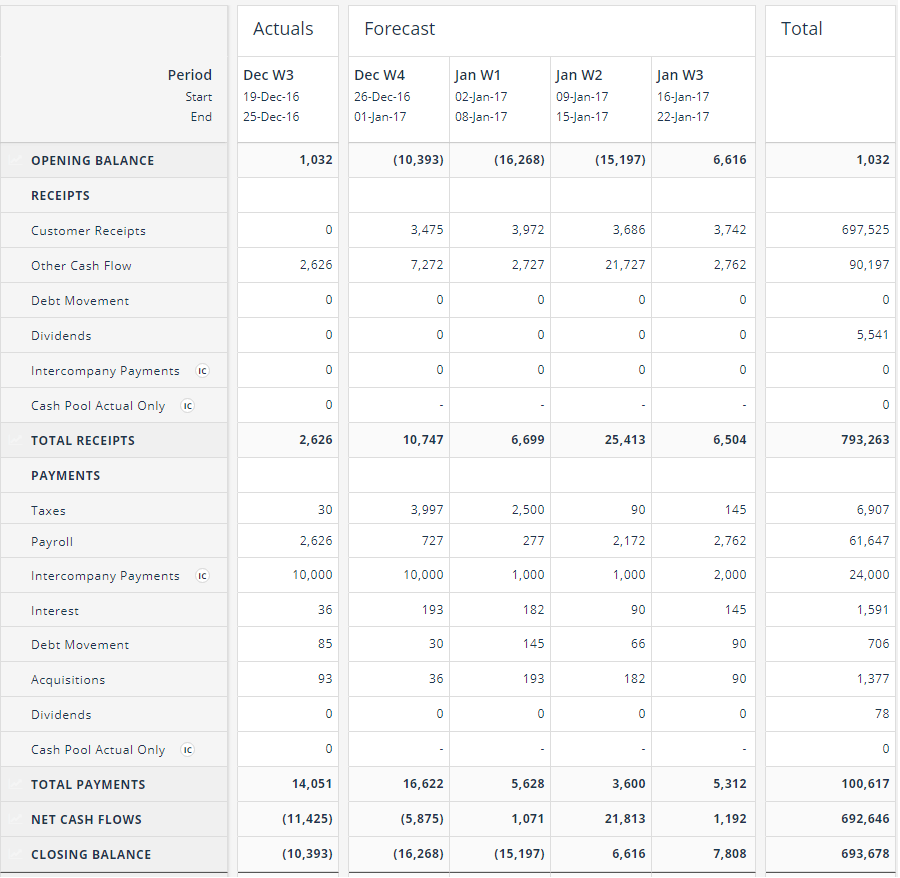

Know the problem: Determine the need to update to better technology and how it can assist with forecasting, what areas it can help with, and whether it can save the team enough time to make strategic decisions.Assess internally: Look for a robust system that can handle end-to-end cash forecasting operations, produce accurate predictions, and provide granular visibility.Here are five tips to take cash forecasting for mid-market treasury to the next level: In unpredictable times, agility is more important than ever. The cash projection might take days, weeks, or even months to put together, depending on the organization, processes, and tools used. Frequency: The frequency with which forecasts must be updated to make timely judgments.ĥ tips to get an accurate cash flow forecastĬash forecasting is a difficult skill to master.Accuracy: The ability to make confident judgments based on the accuracy of forecasts.Visibility: Viewing predictions by categories, regions, and entities, as well as tracking individual cash flows.Some of the key challenges faced in cash forecasting include: Demanding consumer requirements, increased competition, delayed customer payments, managing payables, and maximizing working capital are just a few of the numerous issues faced by them. Key date visibility: Creating cash flow projections for critical reporting dates such as the end of the year, quarter, or month.Ī mid-market company faces several obstacles that have an impact on their revenue.Growth planning: Assure that the company has enough working capital on hand to cover future revenue-generating initiatives.Liquidity risk management: Increase insight into any future liquidity concerns so the treasury has more time to deal with them.Short-term liquidity planning: Manage the funds available on a daily basis to guarantee that the company can meet its short-term obligations.

Organizations most commonly use cash forecasts for the following objectives: Cash flow forecasting prepares a firm to function without financial concerns and creates a pathway to envision business objectives for the near future and the long run. The treasury department performs cash forecasting at regular intervals to foresee future cash positions, prevent debilitating cash shortages, and maximize profits on any cash surpluses they may have.

0 kommentar(er)

0 kommentar(er)